unemployment tax break refund status

What is the status on the unemployment tax break. Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

The IRS has sent 87 million unemployment compensation refunds so far.

. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. Unemployment tax refund status. I filed as soon as I could at the end of January and I still havent gotten anything from the state the online tool to check says theyre still.

Can you track your unemployment tax refund. You wont be able. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

This is available under View Tax Records then click the Get Transcript. We will begin paying ANCHOR. When depends on the complexity of your return.

The IRS has just begun May 14 sending out. The 10200 is the amount of income exclusion for single filers not the. New Jersey State Tax Refund Status Information.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The deadline for filing your ANCHOR benefit application is December 30 2022. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

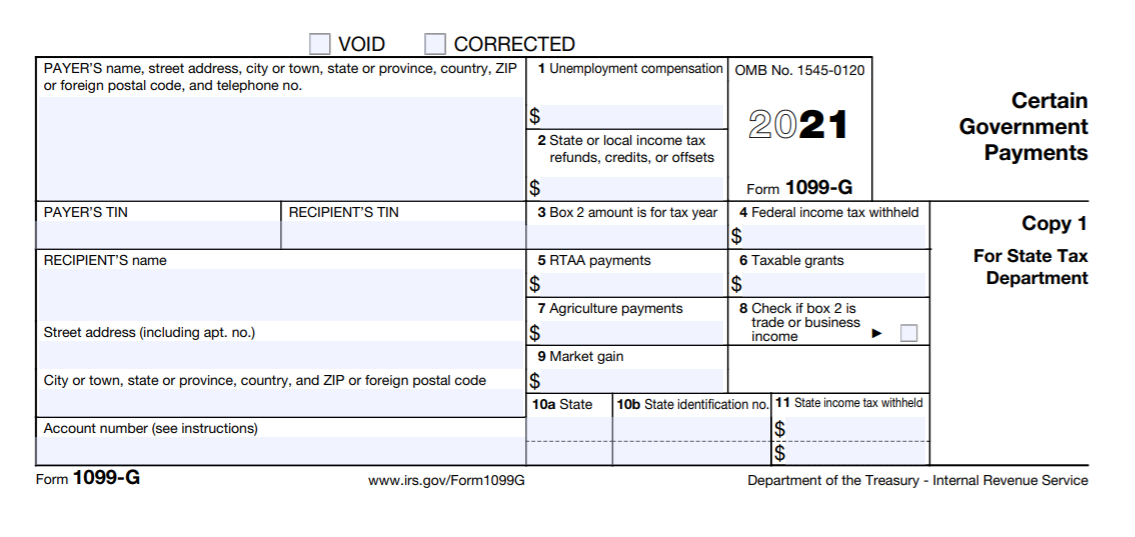

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. By Anuradha Garg. The first10200 in benefit income is free of federal income tax per legislation.

HERES HOW THE 10200 UNEMPLOYMENT TAX BREAK IN BIDENS COVID RELIEF PLAN WORKS Some will receive refunds which will be issued periodically and some will have. Property Tax Relief Programs. This is the fourth round of refunds related to the unemployment compensation.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You can receive your unemployment benefits two ways. When Will The Irs Send Refunds For The Unemployment Compensation Tax Break.

Another way is to check your tax transcript if you have an online account with the IRS reports CNET. The IRS announced earlier this month that the agency had begun the process of adjusting tax. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes. Check the status of your refund through an online tax account. 22 2022 Published 742 am.

Tax Refund Delay What To Do And Who To Contact Smartasset

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

When Will Unemployment Tax Refunds Be Issued King5 Com

Didn T Claim Your Unemployment Tax Break You May Get An Automatic Refund

Unemployment Tax Refund Could Put Thousands Back In Your Pocket

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Some Taxpayers Can Expect Refunds After Covid 19 Relief Bill Gave Unemployment Tax Break 2news Com

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Brinker Simpson

Irs Is Sending Unemployment Tax Refund Checks This Week Money

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Irs Refund 2021 Will I Get An Unemployment Tax Check

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Ohioans Who Paid Income Tax On Last Year S Unemployment Benefits May Get Refunds Cleveland Com

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com