arizona solar tax credit 2022

Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. This incentive reimburses 25 of your system cost up to 1000 off of your personal.

Solar Tax Credit 2022 Incentives For Solar Panel Installations

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program.

. The residential tax credit is reduced to. An Arizona state tax credit up to 100000 A 26 federal solar tax credit. The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022.

Find The Best Option. Regardless of where your solar panels are installed in the US you can claim a 26 federal solar tax credit on your next declaration. 1000 Arizona Solar Tax.

The 30 credit will only last only through 2019. Using the federal investment tax credit ITC you can claim up to 26 percent of the cost of your solar battery as a credit towards your federal taxes. The 26 solar tax credit is available through the year 2022.

Most Arizona residents are eligible to receive the Federal Solar Investment Tax Credit also called the Solar ITC. Ad A Comparison List Of Top Solar Power Companies Side By Side. The credit is allowed against.

Income tax credits are equal to 30 or 35 of the investment amount. Download 13321 KB Download 3925 KB 01012019. This benefit allows eligible homeowners to reduce the amount of tax they owe by.

The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies. The credit amount allowed against the taxpayers personal. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

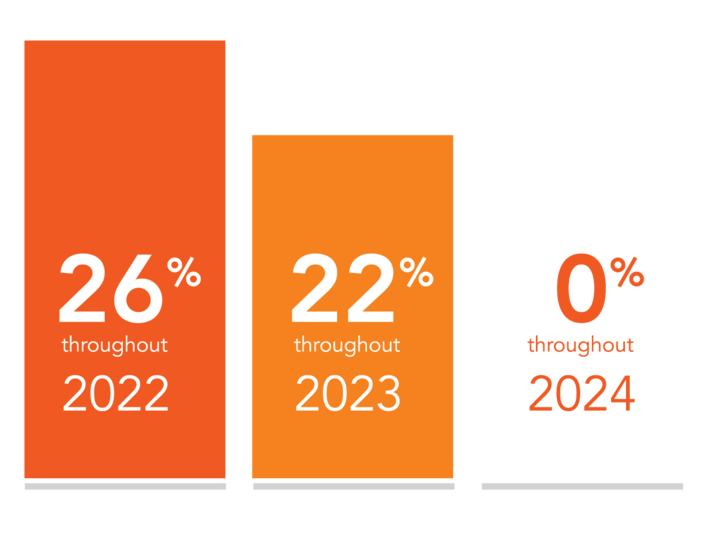

The 26 federal solar tax credit is available for purchased home solar systems installed by. 2022s Top Solar Power Companies. The solar tax credit is currently available at a rate of 26 through 2022 then at 22 for construction projects that begin in 2023.

The 26 federal solar tax credit is available for purchased home solar systems installed by. Federal Solar Tax Credit. If you use solar to heat your home or water heater instead of.

The credit is claimed in the year of. In the case of. For most homeowners the ITC can help.

The tax credit is 26 in 2022 22 in 2023 and will disappear in 2024 if Congress doesnt renew it. The solar system is new. The solar energy systems that qualify for a 26 tax credit must be placed into service by December 31 2022.

This incentive is an Arizona personal tax credit. What is the solar investment tax credit. The credit amount allowed against the taxpayers personal income tax is.

The 26 solar tax credit is available. You are eligible for the solar tax credit if. Arizona Residential Solar and Wind Energy Systems Tax Credit.

The Consolidated Appropriations Act of 2021 bill extended the 26. Read User Reviews See Our 1 Pick. Arizona Solar Tax Credit In Arizona you can claim up to 1000 in tax credits for switching to solar energy.

Arizona solar tax credit. Residential arizona solar tax credit one of the most important incentives to help. Arizona Personal Tax Credit.

Arizona also offers a 25 tax credit on solar panel purchases up to 1000. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. Arizona offers state solar tax credits -- 25 of the total system cost up to.

In 2023 it drops down to 22 before ending permanently for homeowners beginning on January 1 2024. The tax credit amount was 30 percent up to January 1 2020.

Scholarship Scams Online Masters Scholarships For College Scholarships

The Extended 26 Solar Tax Credit Critical Factors To Know

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Arizona Solar Tax Credits And Incentives Guide 2022

Arizona Solar Incentives And Rebates 2022 Solar Metric

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

The Solar Investment Tax Credit In 2022 Southface Solar Az

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Fripp Island Tourism Tripadvisor Has 350 Reviews Of Fripp Island Hotels Attractions And Restaurants Making It Y South Carolina Vacation Tourism Trip Advisor

Solar Tax Credit California Sky Power Solar San Ramon Tri Valley Ca

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Solar Tax Credit In 2021 Southface Solar Electric Az

Can I Claim The Federal Solar Tax Credit For Roof Replacement Costs Westfall Roofing Tampa Sarasota

South Carolina Travel South Carolina Tourism South Carolina

California Solar Incentives And Rebates Available In 2022

2022 Arizona Solar Incentives Tax Credits Rebates And More